He then taught tax and accounting to undergraduate and graduate students as an assistant professor at both the University of Nebraska-Omaha and Mississippi State University. Tim is a Certified QuickBooks ProAdvisor as well as a CPA with 28 years of experience. He spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to tax guide for independent contractors compile financials, job cost, and run payroll. Tim has spent the past 4 years writing and reviewing content for Fit Small Business on accounting software, taxation, and bookkeeping. Sage 50 is excellent general small business accounting software and scored extremely well for general accounting and inventory features. It’s also very affordable for a single user at just $60 a month, but it is the most expensive software in this guide for five users.

Why You Can Trust Fit Small Business

You should also monitor your inventory levels regularly and reorder products before you run out of stock. In both cases, it is important to reconcile these transactions accurately in your accounting system. You get insights into your sales trends, cash flow, and overall business performance. Armed with this knowledge, you can steer your ship towards success with confidence.

- Your P&L is a report that allows you to quickly see all of your revenue and expenses in a given time period.

- You can use tools like Avalara or TaxJar to help with sales tax calculation and compliance.

- Should you decide it’s too much to deal with your business accounting yourself, you could hire an accountant to manage it for you if your budget allows it.

- This can be done by negotiating better rates with suppliers, finding more cost-effective shipping options, and reducing unnecessary expenses.

COGS and FBA Inventory

Investing activities involve buying and selling assets that are not related to the inventory. Fulfillment By Merchant sellers would need to include the purchase of equipment (packaging materials) and property (warehousing) as outflows on their cash statement. My first observation is that my expenses growth didn’t exceed revenue growth. Earlier, when we saw that revenue grew by ~35% from June to July, a little hazard light went off in my head, and I was worried that my advertising costs might have spiraled out of control.

Know your business’s finances

When collecting sales tax, it’s important to clearly display the tax amount on invoices and receipts. You should also regularly file and remit sales tax returns to the appropriate state agencies. Failing to comply with sales tax obligations can result in penalties, fines, and legal action. Once you have tracked your inventory, you should also manage your warehouses effectively. You should optimize your storage space, organize your products logically, and label your shelves clearly.

We recommend customizing your charts of accounts during the initial setup and onboarding. It is just about categorizing all of your transactions on a regular basis – say weekly or monthly. This way, you have defined categories that show where you are spending your money. In particular, two tools that are critical for FBA sellers looking to scale their brand are inventory planning and cash flow forecasting.

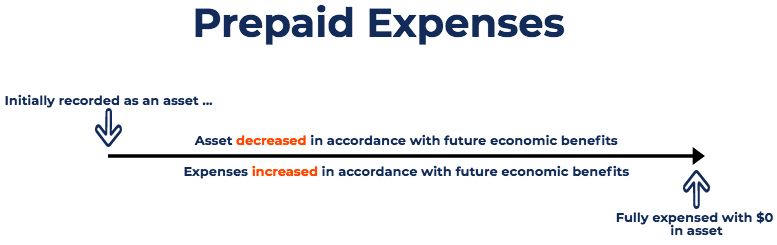

This will help you identify any discrepancies and ensure that your records are accurate. These would be things like meals, travel, continuing education, consulting, product samples, and any one-time costs. A2X’s COGS feature is designed to help sellers better understand their gross profit margin (sales minus COGS). Accounting for the cost of inventory when it is sold provides a more accurate view on business profitability. Regularly reconcile your accounts, review your financial statements, and ensure everything is in shipshape. Cash basis accounting tracks transactions when cash changes hands, while accrual basis accounting records them when the transaction occurs.

This metric will be a good indicator of any changes that need to be made to your product lines. At the very least you will need to perform COGS calculations at the end of the year. Should you decide it’s too much to deal with your business accounting yourself, you could hire an accountant to manage it for you if your budget allows it. While it’s tempting to leave accounting for in your accounting to the end of the year and focus on growing your business instead, doing this is like shooting yourself in the foot. Instead, you’ll be much better off working your bookkeeping and accounting tasks into your everyday routine. Staying on top of accounts payable and receivable is essential to maintaining a healthy cash flow.

When you purchase inventory, the amount of inventory you purchased should be added to your inventory balance. Then, each month you subtract your COGS from your inventory to get a new inventory balance. Bookkeeping is like the meticulous note-taker, recording every transaction and keeping your financial records organized. The advice you receive from your accountant and bookkeeper will only be as good as the information you share with them about your business, growth objectives, and challenges. For example, if you only give them basic information, they are going to duplicate payment controls in sap provide you with more general advice and best practices.

Sage 50: Best Desktop Accounting Software for Amazon Sellers

Not only will it affect your decision-making, but others will have a false sense of how your business is performing. This makes it incredibly difficult to get loans, investors, and to sell your business. You can run a reconciliation report to see if there are any inconsistencies between bank and credit card statements and what is showing up in Xero.

The powerful platforms listed in our guide are generally not as easy to use as simpler accounting software that does nothing but track income and expenses. Our main criteria for ease of use are an easy-to-understand dashboard and UX and the ability to create new transactions with minimal clicks and navigation. Our accounting experts’ subjective opinion on the ease of use of each tool is also a major factor. While there are many advantages to cloud-based accounting software, some users still prefer desktop software. With QuickBooks Desktop no longer selling to new customers after September 30, 2024, Sage 50 becomes the clear frontrunner in small business desktop accounting software. Zoho Books has the best mobile app of any small business accounting software we’ve reviewed.